Lectra announces the acquisition of the majority of the capital of TextileGenesis

Lectra announces the acquisition of the majority of the capital of TextileGenesis

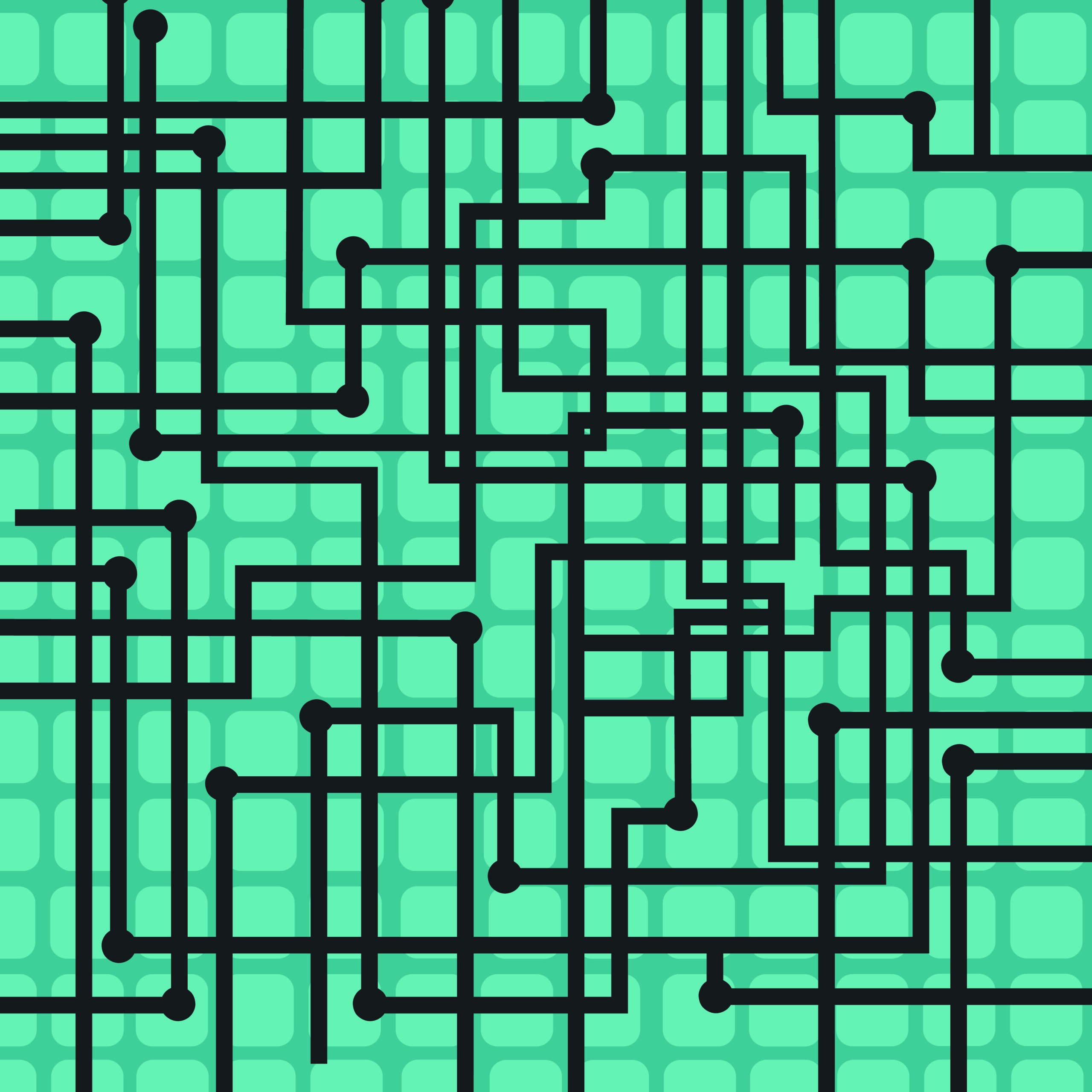

RIAA REPORTS DOUBLE DIGIT MID-YEAR GROWTH FOR U.S. LATIN MUSIC

MediaHound and its team of engineers and product developers will become part of UTA IQ.

The travel and hospitality sectors are in the midst of a massive technological transformation that will affect how you book travel and stay at hotels moving forward. Tech savvy customers will come to expect the convenience that artificial intelligence brings. This vision is what I like to call ‘high-tech automation with high-touch personalization and customization.’ […]

No one likes being watched, offline or on. And it is especially unnerving when a brand oversteps that boundary and pops up everywhere you go online. Invisibly is on a mission to ensure companies have your direct consent for using your data and compensate you for the use of it. Invisibly believes in Seven Core […]

The COVID-19 pandemic and associated restrictions in the spring of 2020, such as stay-at-home orders, led to a drastic drop in U.S. road travel and a sharp increase in the number of people who chose to stay home all day. While the dramatic change in traffic patterns was widely noted last year, new research from […]

In the current age of digital technology, car owners are being forced to consider their vehicle’s susceptibility to ransomware attacks. These malicious cyber-attacks can expose your personal data to online hackers. However, there are certain measures that car owners can take to help prevent security breaches. Proactive car owners are utilizing services like Concentric to […]

Unexpected Trends from IDTechEx’s EV Data & Tools Portfolio 2021 is cementing the electric car’s dominant position in the future of the auto industry as OEMs have increased electrification targets, announced more battery-electric models, and planned new technology adoption strategies. To properly understand these trends, granular, high-quality data is essential. IDTechEx’s portfolio of electric cars […]

Growth of Sushi Restaurants Comes to Halt Tomorrow is International Sushi Day, a day in honor of the popular rice dish from Japan. The latest statistics from BoldData show that the number of sushi restaurants in America has nearly doubled in the last 10 years. However, the growth seems to have come to a halt. […]

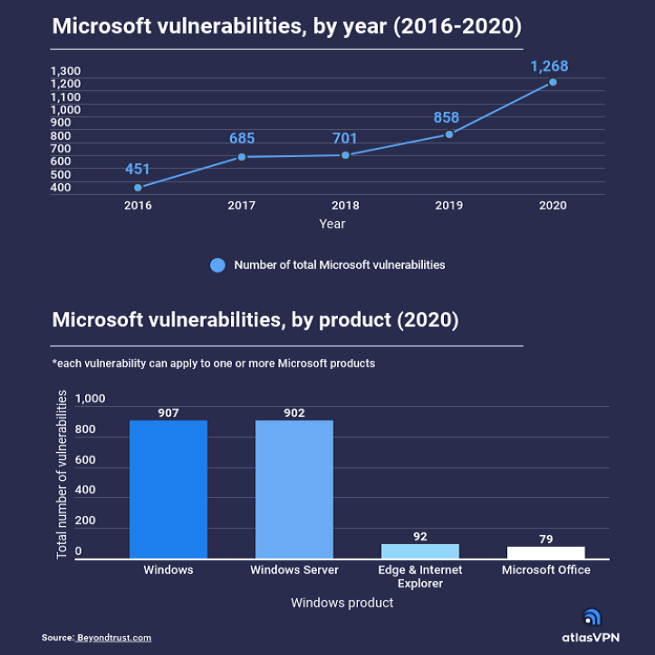

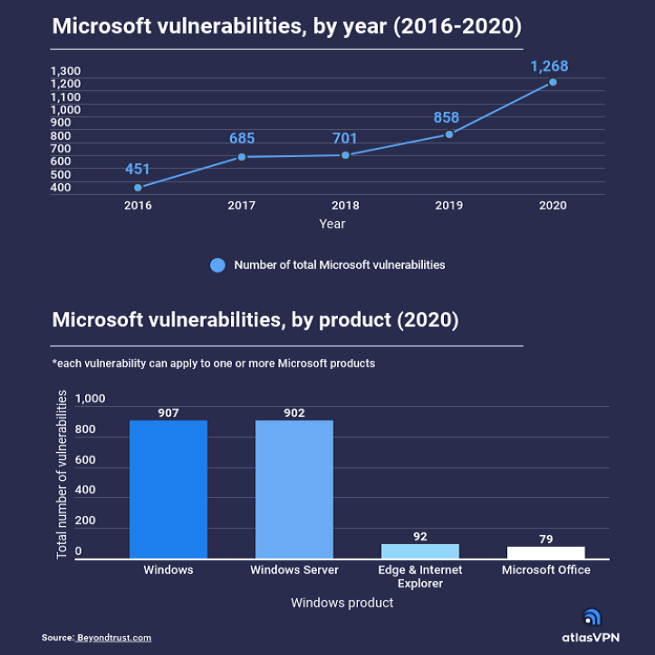

Microsoft products are used by billions of people worldwide. Historically, however, they are known to have many vulnerabilities that pose security risks to users of the software. According to data presented by the Atlas VPN team, the total number of vulnerabilities in Microsoft products reached 1,268 in 2020—an increase of 181% in five years. Windows […]