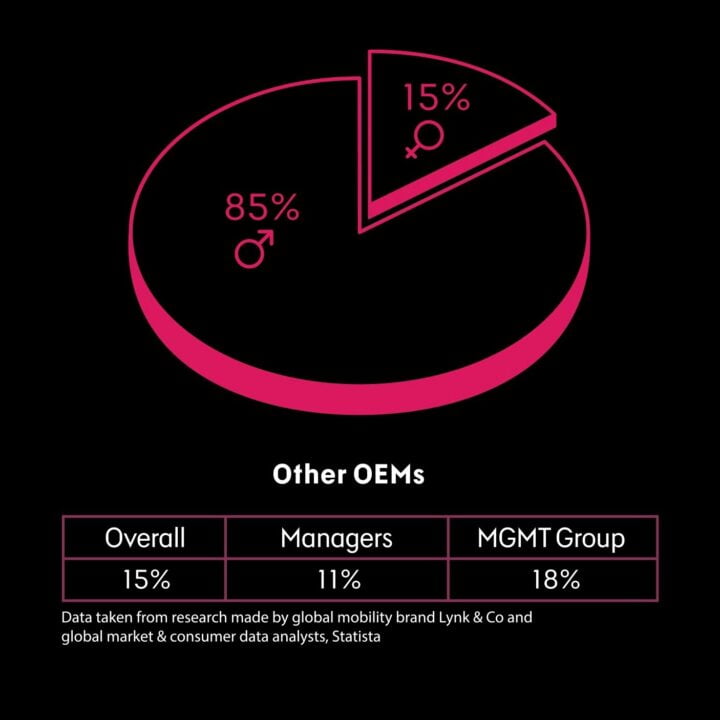

The automotive industry is a dinosaur. Existing for over 100 years and failing to adapt fast enough to society as it evolves. New research from global mobility brand Lynk & Co and global market & consumer data analysts, Statista, compared gender ratios from some of the world’s leading automotive manufacturers and found that the industry […]