Over the past years, the creator or influencer economy has boomed, enabling individual creators, influencers, podcasters, TikTokers, and YouTubers to make six-figure earnings from their businesses.

Over the past years, the creator or influencer economy has boomed, enabling individual creators, influencers, podcasters, TikTokers, and YouTubers to make six-figure earnings from their businesses.

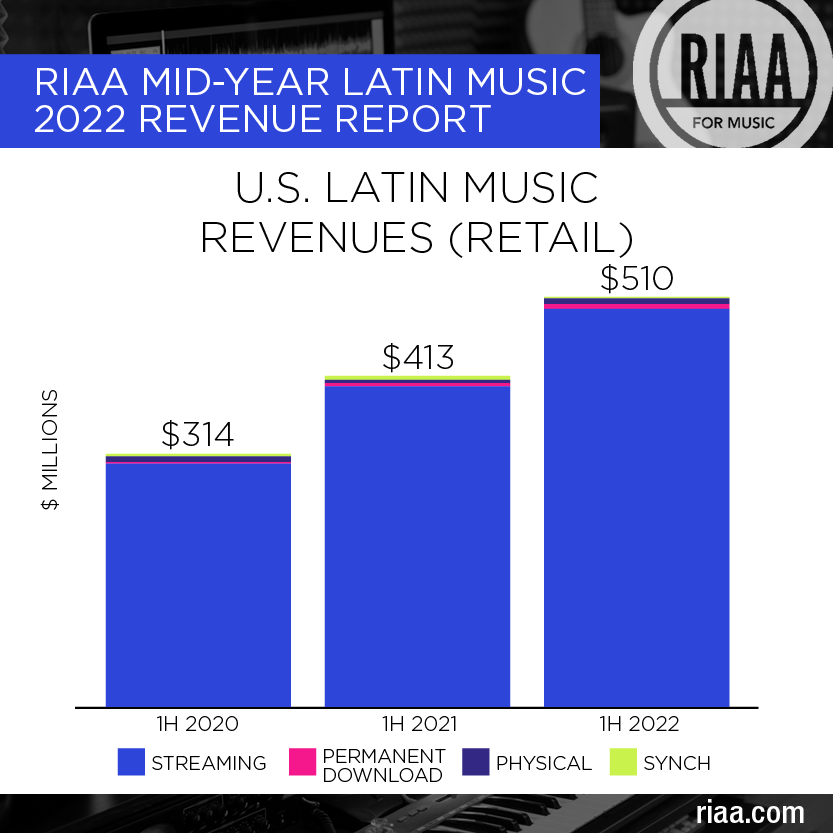

RIAA REPORTS DOUBLE DIGIT MID-YEAR GROWTH FOR U.S. LATIN MUSIC

29-year-old Sam Bankman-Fried has made his mark in the world of crypto, rising to prosperity in such a short period of time as comparable to that of Austin Russell’s Luminar. But how exactly did he do it? Sam Bankman-Friend is the son of two Stanford Law School professors who graduated with a degree in physics […]

Bitcoin miners generate $1.4 billion in May’s revenue despite 36% BTC slump With bitcoin experiencing a price correction of almost 50% in May from the all-time high, mining revenue was expected to take a significant hit. However, contrary to expectations, the revenue has shown resilience. Data acquired by Finbold indicates that bitcoin miners earned $1.45 billion in […]

Global Card Game Market to Hit $6.8B Value by 2025 Over the years, the global card game market has witnessed steady growth and acceptance among players, despite huge competition from digital entertainment sources. However, as millions of people started spending more time indoors amid the COVID-19 lockdowns, the entire sector surged in 2020, with revenues […]

What Marketers Need to Know About Media’s New Currency Source Digital, a leader in providing innovative video advertising, is helping marketers to stop wasting money It’s estimated that digital advertising grew 12% over the last year, as many people were at home more during the pandemic. With billions being spent on trying to reach people as they watch videos, it only makes sense that marketers turn […]

Zoom Hit a Record High Quarterly Revenue of $882.5 Million, Almost a 370% Increase YoY Zoom’s revenues skyrocketed last year as global demand for online meeting solutions soared amid the COVID-19 lockdown. Although the popular video conferencing platform generated impressive revenue through its fiscal year 2021, the year’s final quarter set a new record. According […]

Music Streaming Revenues to Hit $23B in 2021: A 50% Jump Compared to pre-COVID-19 Figures Like many other sectors, the music industry has been significantly affected by COVID-19, with the massive cancelation of live events and huge ticket sales revenue drops amid the lockdown. With earnings from live music events shrunk to the lowest level […]

According to the research data analyzed and published by ForexSchoolOnline.com, Delta Air Lines’ revenue dropped by 88%. It led to a pre-tax loss of $7.01 billion and a GAAP net loss of $5.7 billion. Passenger revenue plummeted by 94% to $678 million while cargo revenue dropped by 42% to $108 million. For H1 2020, there was […]

Data gathered by Safe Betting Sites shows that the NBA sponsorship revenue over the past decade amounts to about $9.24 billion. According to the data, the revenue is projected to grow by 159.33% between 2010 and 2020. Sponsorship revenue to peak during 2019/20 season. The revenue will be highest during the current 2019/20 season at […]