2022 has proven to be nothing short of a significant and eventful year. Overcoming the summer months, 360 reviews and highlights the main news of the month of September.

2022 has proven to be nothing short of a significant and eventful year. Overcoming the summer months, 360 reviews and highlights the main news of the month of September.

2020 exposed the collapse of standardization. We are rapidly moving away from an era defined by outdated standards that held people to conformity and limited their creativity—to today’s new era of personalization that honors one’s individual contributions and embraces fresh ideas and ideals,” said Glenn Llopis, president of GLLG, a leadership and business strategy consulting firm […]

By Hannah DiPilato Recently The New York Times got ahold of President Donald J. Trump’s tax information and made the shocking discovery that he has not been paying his fair share of taxes. According to The New York Times in 2016 and 2017, Trump only paid $750 in taxes each year. Many working Americans pay […]

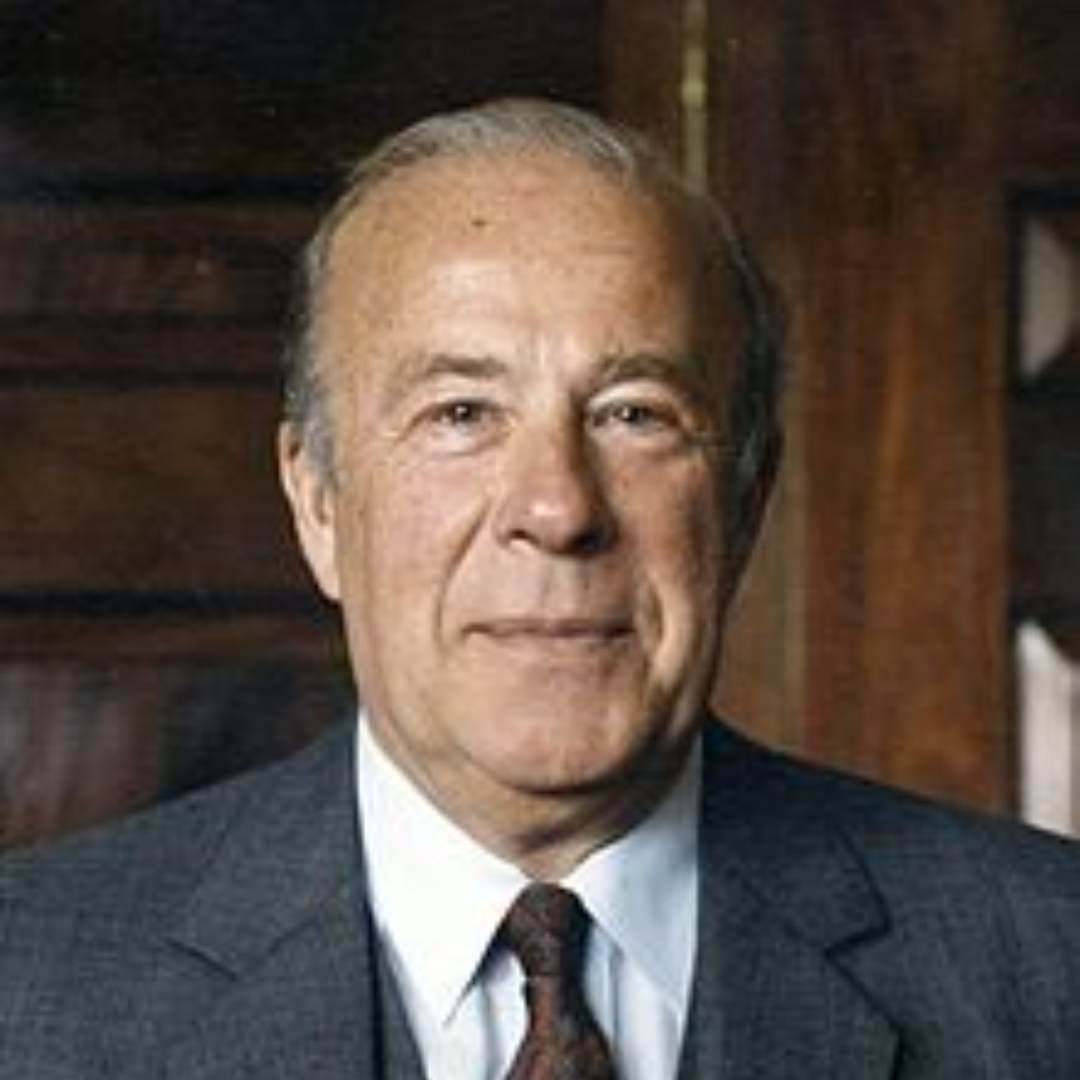

Joined by nearly 250 guests at the historic Old U.S. Mint, the California Historical Society, the state’s official non-profit organization dedicated to preserving and promoting the history of the Golden State, hosted a Gala dinner celebrating The Honorable George P. Shultz on January 11, 2018. “Secretary Shultz has had a distinguished career serving five presidents, […]