The biggest financial literacy podcast, Earn Your Leisure, returned to the Georgia World Congress Center in Atlanta for their 2nd annual Invest Fest.

The biggest financial literacy podcast, Earn Your Leisure, returned to the Georgia World Congress Center in Atlanta for their 2nd annual Invest Fest.

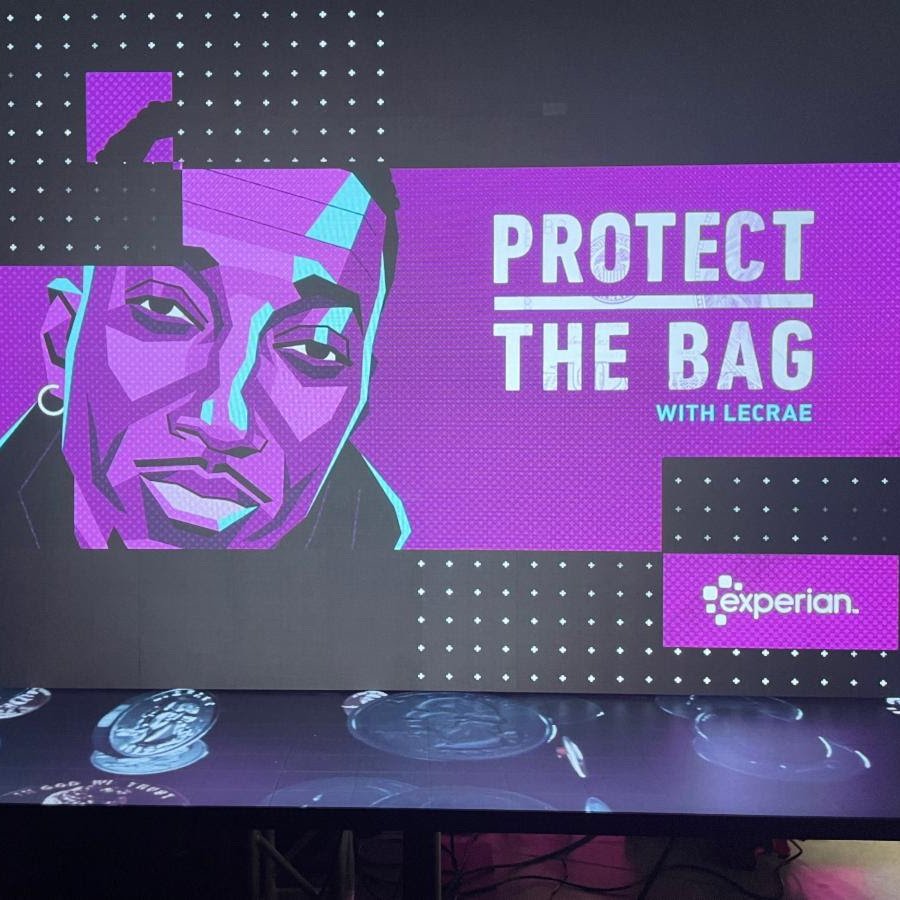

GRAMMY AWARD WINNING ARTIST, LECRAE, TO HOST NEW PERSONAL FINANCE WEB SERIES PROTECT THE BAG, IN PARTNERSHIP WITH EXPERIAN NORTH AMERICA. The Protect The Bag Web-Series Talks About the Basics Of Financial Health! Go from FOMO to legacy building. Grammy Award-winning recording artist, Lecrae, has partnered with Experian North America, a leading information services company, […]

There is a lot to understand when it comes to paying taxes and many Americans have to take it upon themselves to learn the ins and outs of taxes. One aspect many do not account for is the higher tax rate paid once in retirement. The insurance company Nationwide surveyed retirees and found that over […]

At Caffe Roma Lounge in Beverly Hills, ImPOWER Youth hosted their annual “Back to School Fun-draiser”. ImPOWER Youth is a nonprofit dedicated to inspiring and empowering youth to believe in themselves and discover their full potential through mentorship, exposure to opportunities, and life skills development. Nearly 200 people came out in support of ImPOWER Youth and […]

The entrepreneurial spirit in America is alive and well. As they prepare to enter the workforce, seven in ten (70 percent) young adult job seekers say the freedom of being their own boss is worth more than the benefit of job security working for someone else. Additionally, more than half (53 percent) said they are […]